APPLICATION DEVELOPMENT AND SOFTWARE CONSULTING FOR YOUR DIGITAL SUCCESS

Since 2013. We have been providing innovative, result-driven, and versatile digital solutions to assist businesses in connecting with their customers and scaling new heights.

Our Proud Accolades

Enterprise Software And App Developers Australia

Supportsoft is a trusted Sydney based app and software development company that packs a decade-long experience of industry excellence. Our expert team of industry veterans can develop scalable apps and web solutions for any os, device, or platform. We bring together a human-centered approach coupled with the latest industry advancements to provide custom digital solutions that fit your needs with sheer precision.

We provide custom yet bespoke development and support services to growth-focused businesses and government organizations. With Supportsoft Technologies, every part of your IT ecosystem is taken care of, be it IT consulting, its implementation, or security and after maintenance-support. Our team will handle it all.

We strive to give you peace of mind with our unique and transformative digital solutions combined with the latest market trends to help you achieve maximum value for money on your IT investments.

What We Do

We are a prominent software and app development company that excels at entrusting clientele with exploring the complexities of digital evolution. We craft a wide array of bespoke digital products across a diverse range of industries.

Trusted Brands Trust Us

Mobile Application Development

As one of the best app developers Sydney, we have the perfect combination of technical expertise and conceptual understanding of the app marketplace to develop smart applications.

Our team of application developers will collaborate with you to develop a remarkable mobile application whether you are a company looking to reinvent your business or a new venture geared up to take over the market.

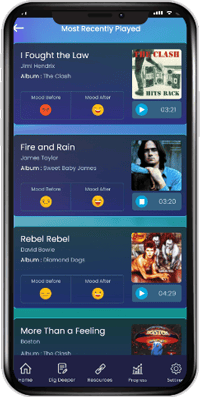

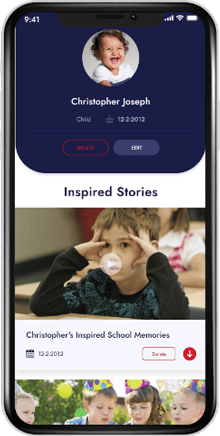

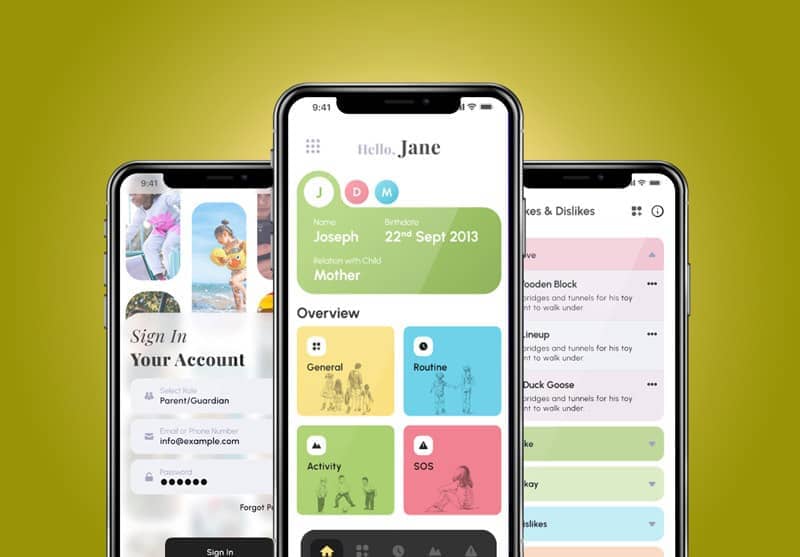

Attentio

Our child behaviour monitoring app helps parents track and monitor their child's behaviour in real time. With the app, parents can set behaviour goals, receive notifications, and access detailed reports. The app can also provide personalized recommendations to improve their child's behaviour, making parenting more manageable and rewarding.

- Customised behaviour goals

- Real-time notifications

- Detailed reporting

- User-friendly navigation

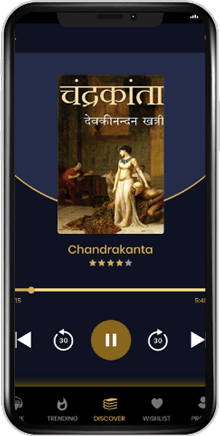

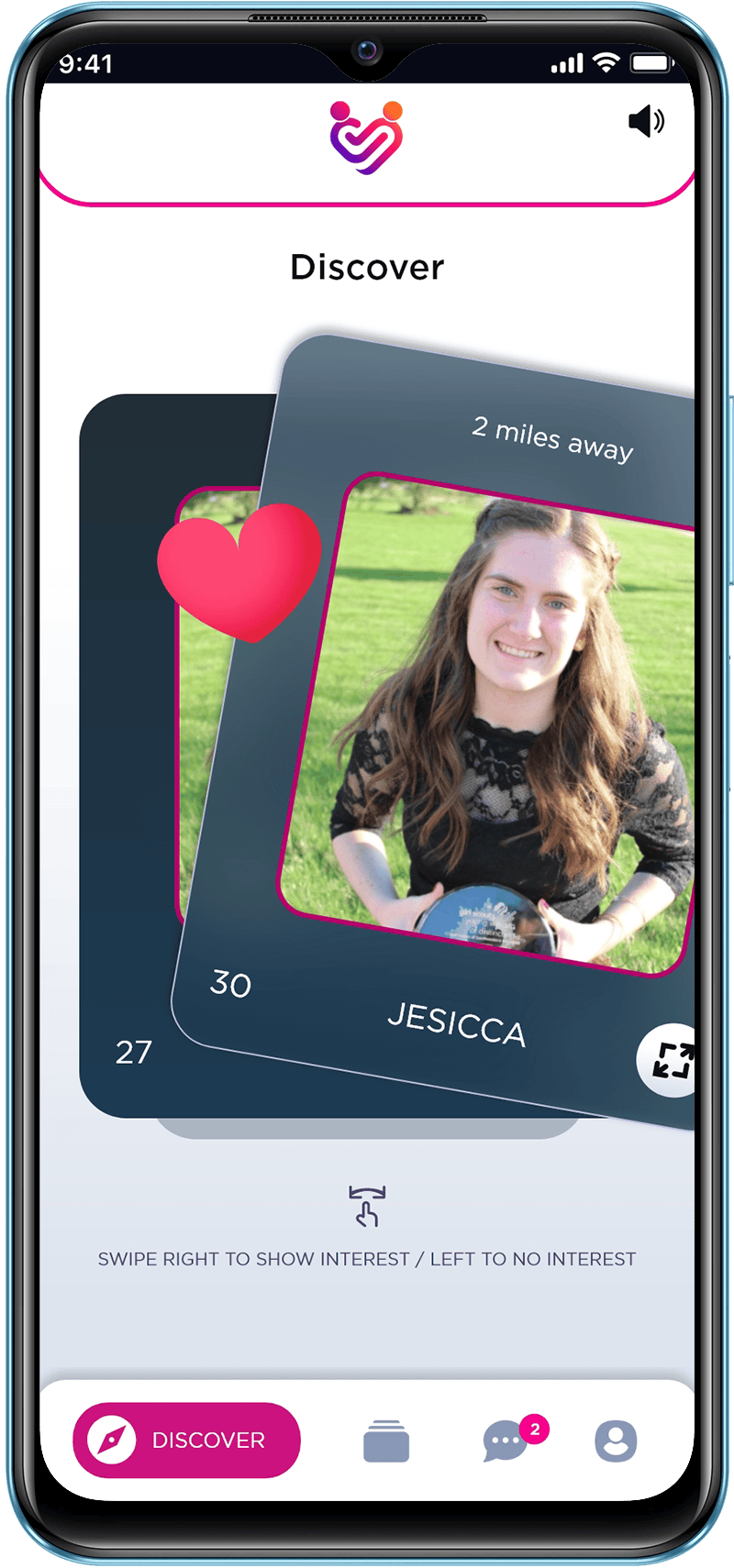

Awed

Our disabled dating app provides a safe and inclusive platform for people with disabilities to connect and find meaningful relationships. The app includes features like accessibility options, privacy settings, and profile verification to ensure a secure and comfortable dating experience. The app also provides resources and support for disabled individuals seeking romantic relationships.

- Accessibility options

- In-app messaging

- Text-to-voice conversion

- Profile verification

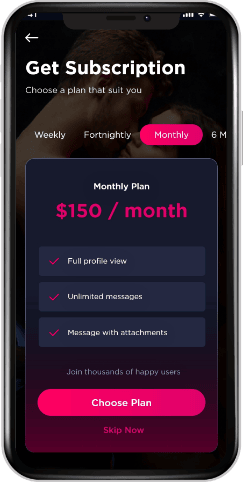

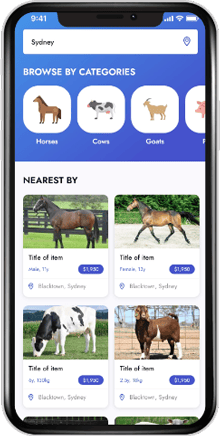

Horse 'N' Herds

Our livestock e-commerce app provides a convenient and reliable platform for farmers and buyers to buy and sell livestock online. With a user-friendly interface, advanced search and filter options, secure payment methods, and real-time messaging, the app ensures seamless transactions. It also allows for easy delivery arrangements and provides excellent customer support for a hassle-free experience.

- Quick user registration

- Advanced search & filter tool

- Secure payment mechanism

- Real-time messaging

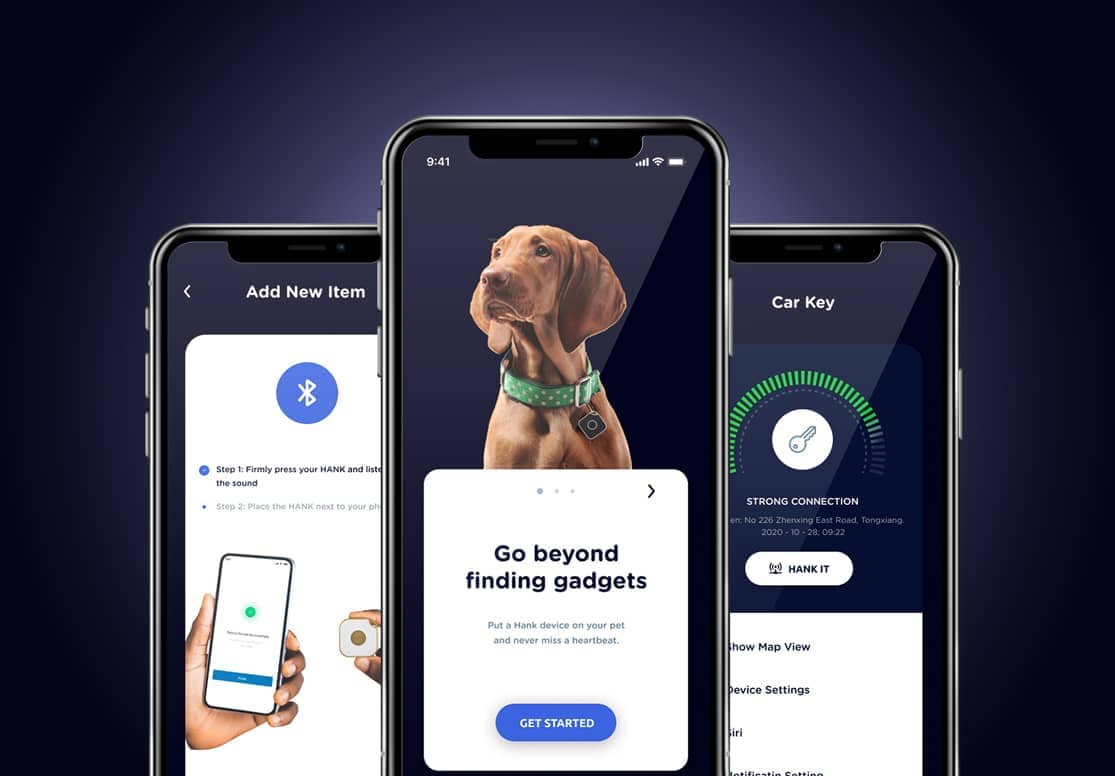

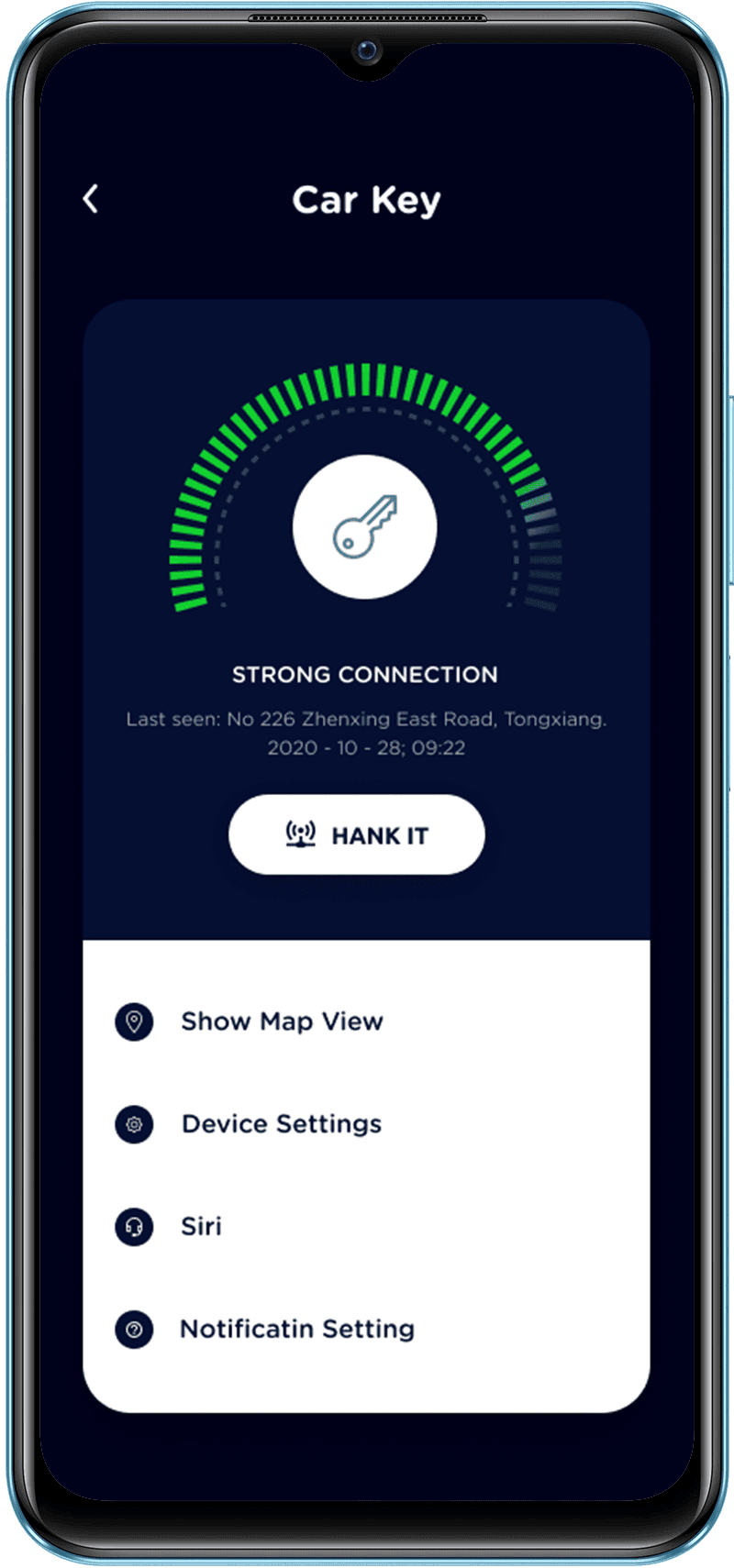

Hank

Our Bluetooth connection-based app enables seamless and wireless communication between two or more Bluetooth-enabled devices. With this app, users can transfer files, share media, and exchange information without the need for an internet connection. The app provides a simple and user-friendly interface, making it accessible to everyone.

- Automatic Pairing

- Multiple device support

- Notification alerts

- Easy navigation & compatibility

We Create Powerful Software Solutions That Help Businesses Succeed

Remarkable Digital Solutions For Your Business

We provide bespoke software development and digital consultancy for businesses. Your journey to a successful digital transformation starts here.

Industries We Work For

Our team has excelled in its expertise in a diverse range of industries to bring positive value to businesses and ventures.

Financial

Automotive

Educational

Real Estate

AdTech and Marketing

Travel and Hospitality

Healthcare

Retail

Logistics

Media and Entertainment

Tailored Website Development

A hand-picked team of web designers and developers that excels at creating websites that inform, pursue and most-importantly convert. We’re your team of website purists that are excited to learn about your goals and help you to achieve them.

Have a project? Lets connect

Get in touch. Our team is here to help 24/7

What Our Clients Say About Us

We are all about customer service but don’t trust our words trust what our clients say about us

Cordwheel Group

Fabulous service, Excellent communication, Prompt response to requests, Reasonable fees. Highly recommended.

Nutritional Products International

Huge cost saving!. Working with them 7 years. Great experience.

Infinite Power Horizons

Great work on the website. Happy with the services. Highly recommend Supportsoft.

The Lift Academy

They did great work on the website. I would definitely recommend their services considering their professionalism and affordable pricing.

Iconic Beauty

Happy with the results they have delivered with the website's SEO. Great experience.

Platforms And Technology Stack We Work With

We make your digital transformation successful with the help of the arms from our technological artillery.

-

Angular.js

-

Node.js

-

.Net development

-

WordPress

-

Vue.js

-

Laravel

-

Magento

-

.Net core

-

Shopify

-

React.js

-

PHP Development

-

ASP MVC

-

HTML5

-

Codeigniter

-

Drupal

-

Adobe photoshop

-

Adobe illustrator

-

Adobe XD

What Helps Us Stand Apart?

We are a company of ingenious minds who have innovative solutions for your every software and digital transformation requirement. Over the years, Supportsoft Technologies has established a reputation as an accomplished result-driven IT solutions provider that helps businesses smoothly achieve their objectives.

-

10+

Years industry experience -

200+

Succesfull projects -

50+

Team members -

100%

Satisfaction assured

Get in touch today!

Reach out to us for your requirements and endeavor your journey to digital excellence with the right team. Our team will also help you create a lucrative MVP for attracting investors to your venture.

Chat with us

Our support will help you from 9am to 5pm AEDT.